Diamond Prices

Read moreThe Ajediam Historical Diamond Prices Chart

Our team proudly presents a new tool developed for you to explore historical price trends for 1.00-carat diamonds. Filter by four quality categories based on color and clarity. The X-axis shows years from 1978 to today, while the Y-axis represents percentage changes in price. Discover insights and trends easily!

Ajediam Historical Diamond Prices Chart: A Comprehensive Overview of Diamond Market Trends

Welcome to Ajediam’s Historical Diamond Prices Chart, where you can explore how diamond prices have evolved from 1960 to today. Whether you are purchasing diamonds for personal use or making a diamond investment, our chart serves as an essential tool for understanding the fluctuations in diamond prices and provides an insightful look at how diamonds have performed as a financial asset over time.

As you navigate through our detailed analysis, keep in mind that diamond prices can vary based on a range of factors, from the global economy to shifts in supply and demand. Our chart will give you the knowledge you need to compare prices and make the best decision, whether you are an investor or a buyer.

- Ajediam Historical Diamond Prices Chart: A Comprehensive Overview of Diamond Market Trends

- Decades of Brilliance: How Diamond Prices Evolved Since the 1960s

- The 1960s marked a pivotal decade for the diamond industry.

- 1970s-1980s: Diamond Price Volatility During Global Uncertainty

- 2008 Financial Crisis: How Diamonds Proved Their Resilience

- 1990s to Early 2000s: Industry Changes & Impact on Diamond Prices

- The Last Decade: Stability Amid Global Economic Challenges

- Diamonds: A Timeless Commodity

- Analyzing Diamond Price Trends: Methodology and Data Sources

- Capitalizing on Market Irregularities: A Case Study

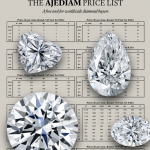

- The Ajediam Price List: A New Approach to Diamond Price Transparency

Decades of Brilliance: An Analytical Examination of Diamond Prices Since the 1960s

Decades of Brilliance: How Diamond Prices Evolved Since the 1960s

The journey of diamond prices over the last six decades reflects both global economic shifts and the evolving role of diamonds as a tangible asset. Understanding the fluctuations in diamond pricing not only requires knowledge of the market but also insight into historical events, changing consumer behaviors, and the rise of new diamond-producing regions. As diamonds were increasingly viewed as both a luxury good and an investment asset, their price trajectory mirrored broader economic cycles.

Over the years, diamond price trends have been influenced by geopolitical events, technological advancements in mining, and changing market dynamics. This comprehensive analysis will guide you through each period, highlighting the key drivers behind price changes and providing context for today’s diamond market.

The 1960s marked a pivotal decade for the diamond industry.

Following the economic boom after WWII, there was a surge in consumer demand for luxury items, and diamonds were no exception. The rise of marketing campaigns, such as De Beers’ famous “A Diamond is Forever,” helped establish diamonds as the ultimate symbol of wealth, love, and status. This marketing strategy effectively shaped consumer perceptions, creating a robust demand that outpaced supply, driving up prices.

During this time, De Beers controlled much of the global diamond supply, and its pricing policies ensured a steady increase in prices. With supply constraints and growing demand, the diamond price index began its upward trajectory, setting the stage for the steady increases in diamond prices seen throughout the late 20th and 21st centuries.

Key Factors Influencing Prices:

- Post-WWII economic growth and rising affluence

- De Beers monopoly on diamond production and distribution

- Marketing strategies that democratized luxury and increased global demand

The increasing wealth in the Western world and the allure of diamonds as an enduring symbol of luxury made the 1960s a defining period for diamond pricing.

1970s-1980s: Diamond Price Volatility During Global Uncertainty

The 1970s and 1980s brought significant volatility to the diamond market. Political instability, economic crises, and the rise of global inflation led to fluctuating diamond prices. These decades were marked by sharp price increases followed by abrupt downturns as a result of geopolitical events like the oil crisis and economic instability in diamond-producing regions.

During these years, diamonds still remained a stable store of value, but market fluctuations and diamond pricing volatility were noticeable. The shift away from De Beers’ monopoly in the 1980s and the emergence of new diamond-producing countries like Russia and Botswana had a long-lasting impact on supply and pricing strategies.

Key Events and Trends:

- Geopolitical instability affecting diamond production and demand

- Global inflation and its impact on pricing

- Increased competition in the diamond production market

Despite these fluctuations, diamonds continued to demonstrate economic resilience as a long-term investment, attracting individuals seeking to preserve wealth in times of financial uncertainty.

2008 Financial Crisis: How Diamonds Proved Their Resilience

The 2008 financial crisis tested the stability of all asset classes, but diamonds proved to be a resilient investment during this tumultuous time. Although prices for many commodities fell sharply, diamonds saw an initial dip but quickly rebounded. In fact, diamonds performed better than many other investment options, illustrating their ability to hold value and withstand market volatility.

During this period, diamonds were increasingly recognized as a safe-haven asset—an alternative to traditional financial markets. Investors turned to diamonds as a way to hedge against economic instability and inflation, reinforcing their status as a secure investment.

Why Diamonds Weathered the Crisis:

- Diamonds’ status as a tangible asset and inflation hedge

- Recovery driven by strong demand in emerging markets

- Decreased supply as global production slowed during the crisis

The diamond price recovery post-crisis demonstrated how diamonds can outperform other asset classes during times of economic uncertainty, cementing their place as a timeless investment.

1990s to Early 2000s: Industry Changes & Impact on Diamond Prices

The 1990s and early 2000s brought significant changes to the diamond industry, which in turn had a profound effect on diamond prices. The most notable event during this period was the collapse of De Beers’ monopoly. New diamond producers, particularly in Russia and Africa, increased global supply, putting downward pressure on prices. However, the rise of new consumer markets, particularly in Asia, helped sustain global demand.

Despite the increase in supply, the diamond industry managed to maintain strong prices due to the robust demand from emerging markets, particularly China and India.

Key Changes and Trends:

- The decline of De Beers’ market dominance

- The growth of Asian markets for diamonds

- The rise of synthetic diamonds and its effect on prices

While diamond pricing pressures from increased competition emerged, the industry’s adaptability allowed diamonds to maintain their luxury status and value proposition.

The Last Decade: Stability Amid Global Economic Challenges

Over the past decade, diamond prices have shown stability, even amid global economic challenges like trade wars, shifting consumer behavior, and the COVID-19 pandemic. The resilience of diamonds as a long-term investment has been clearly demonstrated, with steady increases in prices, particularly for higher-quality diamonds and rare stones.

Unlike the volatility seen in previous decades, the diamond market in the past decade has been more predictable with a consistent upward trend in prices. This section will explore why diamonds have become a favored choice for investors in recent years.

Factors Contributing to Stability:

- Rising demand for luxury items from millennials and Generation Z

- Increased transparency in diamond pricing and the use of advanced technology to track prices

- Decreasing global supply of high-quality diamonds

Tracing the Evolution of Diamond Prices: Data Sources and Historical Context

Diamonds: A Timeless Commodity

Diamonds have been traded and highly valued since ancient times. These precious stones have been associated with wealth, status, and even divine protection, with records of their use and trade dating back thousands of years.

Even though the systematic recording of diamond prices only allows us to go back to the 60s, it’s important to remember that the value and desirability of diamonds are rooted in a history that spans millennia. The diamond trade of today is the latest chapter in a story that has unfolded across cultures and continents and continues to evolve in the modern era.

Analyzing Diamond Price Trends: Methodology and Data Sources

What drives diamond price trends? In this section, we explore the various factors that influence diamond prices, from global economic conditions to shifts in consumer behavior. The interplay of supply and demand, economic growth, and geopolitical stability all contribute to the pricing dynamics that investors and buyers must understand.

In order to paint an accurate picture of diamond price trends over the last six decades, we’ve relied on a combination of historical data and firsthand market experience. Our analysis draws heavily on extensive research conducted by the Rapaport and IDEX Groups, the leading sources of diamond pricing information, along with our extensive experience and intimate knowledge of the diamond market. These rich data sources provide a robust foundation for our exploration of the complex dynamics that have shaped diamond prices since the 1960s.

This section explains how diamond price charts are compiled and how you can use them to compare prices over time. We’ll also delve into the nuances of interpreting market discounts and other hidden factors that can affect final transaction prices.

Recognizing the Limitations of Diamond Price Data

When evaluating historical diamond price trends, it’s crucial to understand the limitations of the data we rely on. While we base our analysis on trusted sources like Rapaport and IDEX, it’s important to note that these price indices may not capture every nuance of the diamond market.

The diamond industry is complex and influenced by multiple factors that can fluctuate rapidly. Price discrepancies, especially with rare or high-carat diamonds, may not always be reflected in standard price reports. Additionally, the market discounts that savvy traders often navigate are not always visible in public data, which can result in a discrepancy between listed prices and actual transaction prices. For instance, diamonds from specific sources or with particular characteristics might be priced lower or higher depending on their quality and demand within niche markets.

Our aim is to provide as accurate and comprehensive a view as possible. However, we encourage investors to consider these market variables when assessing diamond prices, as the landscape is constantly evolving. A more thorough understanding of the market can empower you to make more informed investment decisions.

Market Discounts: A Hidden Dimension of Diamond Pricing

Market discounts can significantly affect the final price you pay for diamonds. Experienced investors and traders know how to leverage these discounts to their advantage, which is why understanding this hidden aspect of pricing is crucial.

In this expanded section, we’ll show you how market discounts influence pricing and how to navigate them when buying diamonds.

One such complexity relates to market discounts. While the Rapaport and IDEX price indices offer well-developed categories and comprehensive data, they don’t necessarily illuminate the market discounts that experienced traders are familiar with. For instance, a decade ago, a 1-carat D Internally Flawless (IF) diamond might have sold at 30% to 25% less than the Rapaport listed price, while a 1-carat E Very Very Slightly Included 1 (VVS1) diamond might have sold for 15% less. These discrepancies aren’t immediately evident from the price indices alone, but can significantly impact the actual transaction prices in the diamond market.

Capitalizing on Market Irregularities: A Case Study

Case studies provide a powerful way to illustrate how market fluctuations can create investment opportunities. In this section, we look at a specific case study where savvy investors capitalized on diamond price discrepancies and saw substantial returns. We also explain how you can use similar strategies to enhance your own investment portfolio.

The German financial organization’s strategic maneuver to buy out all 1-carat D IF diamonds on the market serves as a perfect example of how understanding and capitalizing on market irregularities can lead to substantial gains. Recognizing these diamonds were undervalued due to the market discount, the investors‘ bulk purchase led to them being able to decrease the market discount on these diamonds to 15%, with an outcome that appears to have yielded a significant profit.

This move, both audacious and meticulously calculated, is an impressive showcase of how to make a profitable investment in the diamond market. Even experienced traders were left impressed by this strategy. For more insights and advice on diamond investment, you can read more about investing in diamonds.

The Ajediam Price List: A New Approach to Diamond Price Transparency

At Ajediam, we’re committed to providing transparent diamond price list that reflects the real market dynamics, including hidden discounts and other factors that can impact the price of diamonds. This section explains how we’ve redesigned our price list format to better serve our customers and investors by incorporating these insights.

This format aims to provide a more accurate and comprehensive view of diamond prices for our visitors who may not have insider knowledge of professional diamond traders.

However, it’s important to note that our new price lists including our market discount records only date back to 2023. For the purposes of this study, which traces diamond price trends back to the 1960s, we’ve used the industry-standard Rapaport and IDEX data. This reflects the ongoing evolution of diamond price reporting, as well as the challenges and opportunities that come with understanding and navigating this complex market.

Conclusion: The Enduring Allure and Economic Resilience of Diamonds

Diamonds remain a resilient and enduring investment, having proven their ability to weather economic downturns, market volatility, and global crises. In conclusion, whether you’re buying a diamond for personal enjoyment or investing for the future, diamonds continue to offer security, stability, and growth potential. If you are ready to explore diamond investment in one of our experts, book your appointment here.

Our charts show that investing in diamonds can yield returns over time when properly executed. The key is to buy when prices are low and sell when prices are high. By investing in diamonds, you are not only protecting your wealth from inflation and economic crises but also potentially expanding it. Read more about investing in diamonds